Every day, your contact center fields thousands of conversations where customers volunteer information that you’d pay handsomely for in a traditional focus group. What’s broken with your product. How competitors are positioning against you. Feature wish lists.

Churn signals.

All of which can help you fix what’s broken, outmaneuver competitors, and retain customers before they leave. Failing to do so may be a costly strategic blunder: according to Qualtrics, businesses collectively risk nearly $4 trillion globally because of bad customer experience.

So why do so many organizations still struggle to make the most of their customer data?

The Cost Center Trap

According to ICMI and Zendesk Research, 62% of contact centers are perceived as cost centers by the rest of their organizations. That perception shapes everything downstream, from investment decisions driven by cost reduction to strategic intelligence dying on the vine (because nobody thought to ask the contact center what customers are saying).

With every call, chat, and email, customers are telling you where the breakdowns exist in your products, processes, and experiences. If those insights stay trapped in the contact center—used only to handle calls better—you’re missing the bigger opportunity.

Think of the contact center as an organizational antenna, picking up signals that few other organizational units can hear (and that most surveys fail to capture):

|

Product intelligence |

Competitive intelligence |

Market signals |

The potential is considerable. McKinsey research shows inbound customer service centers can contribute up to 25% of total new revenues for credit card companies and a remarkable 60% for telecom operators. But these aren’t the only industry verticals that are waking up to the value of contact center intelligence.

Revenue generation in contact centers has improved from being a priority for roughly one in 20 customer care leaders in 2016 to one-third in 2024, according to McKinsey’s ongoing global surveys of customer care executives. McKinsey estimates that companies implementing customer value execution strategies in their contact centers can increase topline revenues by 10-20%, even in highly saturated markets.

The business case for this shift is clear: Forrester’s 2025 research found that companies aligning brand promise with customer experience can unlock up to 3.5x revenue growth while significantly boosting customer loyalty.

Where the Intelligence Needs to Flow

The contact center is a hub of communication. It’s a source of rich customer insights that can be harnessed and shared across the organization, but only if the pipes are connected.

Here’s what those critical connections may look like:

- Product: Defect patterns, feature requests, and usability issues. When repeat calls cluster around specific products or customer journey stages, that’s a signal. Customers are calling back because the initial solution didn’t work. In software organizations, this escalation pathway often exists already. Cases get flagged internally when patterns emerge. The question is whether it happens fast enough, consistently enough, and with enough data to act on. Catching a defect pattern early could save millions in recalls or returns.

- Marketing: Competitive intelligence, messaging effectiveness, campaign feedback. Track competitor positioning shifts as they happen. Identify what promises competitors are making and where they’re failing to deliver. Every mention is market research you didn’t pay for.

- Sales: Churn risks and expansion signals. Your agents are hearing buying signals and churn warnings every day. The question is whether that intelligence reaches the people who can act on it. In B2B, the opportunity is connecting contact center intelligence directly to existing systems, enriching the signals sales teams already track. In B2C, the value lies in pattern recognition: using data from similar situations to guide agents on what works.

- Executive Leadership: Strategic market signals, pricing sensitivity trends, brand perception in real-time. The contact center sees it all; leadership has to see it too to believe it.

To achieve this flow, leading organizations are building new models: QA teams evolving into hybrid teams carrying out quality assurance and business analysis side-by-side. They’re becoming the customer hub that feeds insights into all other areas of the business.

Building the Piping that Insights Need to Flow

Making this real requires infrastructure that connects the contact center to the rest of the organization.

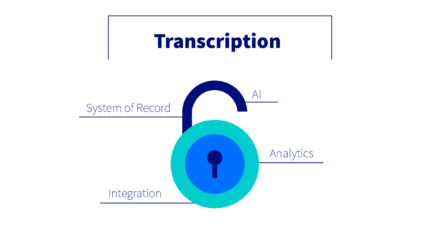

Transcription should be a priority. You can’t extract intelligence from conversations you haven’t captured. High-quality, accurate transcription turns voice interactions into structured data that can be analyzed and shared at scale.

Connect the pieces from there:

- Analytics that answer ‘what’s happening’ and ‘why’: solutions like Cisco AI Assistant for Webex Contact Center provide Topic Analytics that quickly identify incoming call drivers, enabling proactive issue resolution.

- Integration with CRM and marketing platforms so insights reach the people who act on them: Webex Contact Center’s native Salesforce integration gives businesses a 360° view of every customer, combining CRM data with contact center analytics.

- AI-powered pattern recognition that surfaces signals humans would miss.

- A single system of record that eliminates the contact center as an information island: Salesforce Data Cloud can unify customer data across sources, making it available for real-time activation across sales, service, and marketing.

Questions Worth Asking

Before your next budget cycle, ask yourself:

- How much do we spend on market research annually? How much customer intelligence is already sitting in our contact center data?

- What’s our process for routing product defect signals to the product team?

- Who outside the contact center sees our conversation analytics?

- When customers mention competitors, where does that information go?

- If a pricing sensitivity trend emerged in customer conversations, how long would it take to reach leadership?

Your contact center knows things nobody else does. The question is whether you’re set up to hear it and whether the rest of your organization ever will.

This piece focused on what your contact center knows. The companion piece covers what to do with it; i.e., agent coaching, quality monitoring, and personalization strategies that turn insight into action: Why Conversational Data is a Contact Center Gold Mine.