GDPR compliance is not an end state. It’s a baseline for the forward-thinking financial services enterprise already strategizing for what’s next in data privacy. At least they ought to be, given the expansion—and fragmentation—of binding data regulations in Switzerland, Europe, and beyond.

Key Data Privacy Regulations for Financial Services in 2025

|

EU regulation that requires financial institutions and their technology providers to implement comprehensive (Information and Communications Technology) risk management, incident reporting, and third-party oversight measures. |

|

|

Switzerland’s comprehensive data privacy law that aligns with GDPR standards while adding “Swiss finish” requirements including fines up to CHF 250,000, mandatory breach reporting, and expanded protections for genetic and biometric data. |

|

|

Mandates cybersecurity requirements and incident reporting obligations for critical infrastructure providers (including financial services), with a 2025 revision expected to expand coverage and require cyber-attack reporting within 24 hours to align with EU NIS2 standards. |

|

|

Binding regulatory guidelines issued by the Swiss Financial Market Supervisory Authority that specify detailed requirements for how banks, insurers, and other financial institutions must implement Swiss financial laws. |

|

|

CFPB Personal Financial Data Rights Rule (United States) |

The Consumer Financial Protection Bureau requires financial institutions to unlock and transfer consumers’ personal financial data to other providers at the consumer’s request for free, enabling open banking and giving consumers greater control over their financial information. |

|

EU-wide cybersecurity regulation that expands coverage to 18 critical sectors (including financial services), requiring organizations to implement comprehensive risk management, report incidents within 24 hours, and manage supply chain security. |

|

|

Council of Europe’s first international legally binding treaty on AI (signed by Switzerland in March 2025) that establishes standards for AI development and use to protect human rights, democracy, and the rule of law. |

Swiss data privacy requirements are particularly stringent, going well beyond regulatory minimums to build unassailable trust. In financial services, trust is the name of the game, which is why so many firms are prioritizing their approach to data privacy.

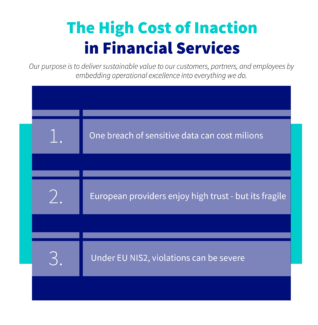

Regulatory Avalanche, consumer Trust, and the High Cost of Inaction

In Data sovereignty in uncertain times, we explored two critical aspects of cloud risk: data confidentiality and data availability. These risks carry heightened consequences for financial services firms.

A single breach of sensitive data can carry huge costs for the responsible party, to the tune of multiple millions, by some estimates. Availability failures can freeze customer transactions, trigger regulatory penalties, and erode hard-earned customer trust.

Thanks to one of the strictest regulatory environments in the world, trust in European financial providers remains relatively high. Yet the same trust that takes years—even decades—to build requires only one breach, oversight, or violation to disappear.

Consider this: a violation of the EU NIS2 Directive carries a penalty of up to €10 million or 2% of global turnover.

The New Demands of an AI-first World

One of the most alarming revelations from IBM’s 2025 Cost of a Data Breach Report (referenced above): 97% of organizations that experienced an AI-related security incident lacked proper AI access controls.

Even more troubling, 63% of organizations have no AI governance policies in place to manage AI or prevent workers from using shadow AI— unauthorized AI tools downloaded from the internet without IT oversight.

This governance gap is widening, just as financial services firms expand their use of AI across operations, including:

- Generative AI in wealth and asset management

- Executing automatic trades and evaluating creditworthiness

- Identifying potential customer risks

- AI-driven marketing

- Reducing fraud

…all of which expands potential attack surfaces.

AI may enhance fraud detection, for example, but also make it difficult for analysts to trust, validate, and refine decisions, posing challenges for compliance, fraud explanation, and adversarial defense.

Indeed, every AI model becomes a potential entry point for sophisticated attacks: data poisoning that corrupts training sets, adversarial inputs that manipulate outputs, and model inversion attacks that extract sensitive training data.

The 3 Rs of Responsible AI

EY outlines the 3 Rs of Responsible AI, providing a useful approach to avoiding these pitfalls:

- Regulation: Monitoring and complying with the latest regulations

- Reputation: Maintaining a strong record of fairness and transparency

- Realizing: Extracting value from AI through responsible practices

Why Financial Services Turn to Swiss-Grade Data Protection

Switzerland’s data privacy laws are considered by many to be the strongest in the world. The Swiss FADP (Federal Act on Data Protection) plays a major role in this reputation. An organization in compliance with FADP makes foreign or third-party data access far less likely.

Swiss-based data providers operate under a unique legal and political framework that offers a “digital safe haven” for sensitive information. This approach is built on several key pillars that are especially attractive to the financial services enterprise:

- Robust legal framework: FADP was recently revised to align more closely with EU’s GDPR. It enforces strict principles of transparency, proportionality, and purpose limitation for data processing. It also establishes an independent legal framework for data protection not easily superseded by foreign laws.

- Political neutrality and sovereignty: Switzerland is not an EU or EEA member and is not subject compulsive data sharing between member nations. The country is jurisdictionally insulated, a key advantage for financial services firms.

- Culture of privacy: Discretion and confidentiality remain core tenets of the Swiss finance and banking sector, in particular. Here, privacy is treated as a fundamental right.

It’s a compelling picture for financial institutions, who handle some of the most sensitive data imaginable, including personal identifiable information (PII), transaction histories, asset details, and proprietary trading strategies.

By choosing Swiss-grade data protection—and third-party providers with servers based in Switzerland—financial firms can assure their clients that their sensitive information is shielded from today’s most costly data-privacy risks.

STAY UP TO DATE

The Trusted Provider Advantage

While the Swiss legal framework provides a powerful foundation for data security, the choice of a technology partner is where these principles are put into practice. For financial institutions evaluating cloud communications and contact center solutions, the provider’s own infrastructure, policies, and jurisdictional standing are critical.

It starts with dedicated European data centers.

For instance, Bucher + Suter offers private cloud contact center solutions built with Cisco technology that are owned and operated exclusively for its client organizations. That means client’s (and our client’s clients’) data remains within European jurisdictions, fully compliant with aforementioned data sovereignty regulations, and shielded from the reach of foreign laws like the U.S. CLOUD Act.

In addition to meeting the highest industry standards, including HIPAA, GDPR, ISO 270001, Bucher + Suter is now listed on the EU – US Data Privacy Framework, which ensures that our customers’ data is legally and securely transferred between Europe and the U.S .

In a time defined by regulatory complexity and emerging AI-driven risks, the mandate for financial institutions is clear: move beyond baseline compliance to build true digital resilience.

A forward-thinking data privacy strategy, grounded in the highest principles of security and data sovereignty, is no longer just a risk-management measure. It’s the core foundation for ensuring that customer trust—the most valuable asset of all—remains unbreachable.

Questions about your firm’s data privacy strategy vis-a-vis cloud communications and contact center? Contact our team of experts today to discuss options.